Have you ever wondered what one of TAM’s Investment Committee meetings looks like? Often, reaching a consensus takes much back and forth and sometimes it can feel like a bit of a boxing match. So, true to form we wanted to bring you our latest match up. In this note, framed as a classic head-to-head bout, Dan Babington, TAM’s Portfolio Manager and TAM’s Independent Macroeconomist, Alex Dryden look to determine whether growth or value investing will reign supreme in the years to come.

This note was originally published on Alex’s macro blog Financial Fables. For weekly market insight you can subscribe here.

In equity markets, two rival styles are often cast as fighters in opposite corners of the ring: value investing and growth investing. Value investing focuses on companies whose shares appear cheap relative to fundamentals. Growth investing, by contrast, targets companies expected to expand rapidly, even if their current valuations look expensive. In theory, this should set up a fairly even contest. Each style ought to enjoy periods where it dominates the bout, followed by rounds where it takes a few hits and falls behind.

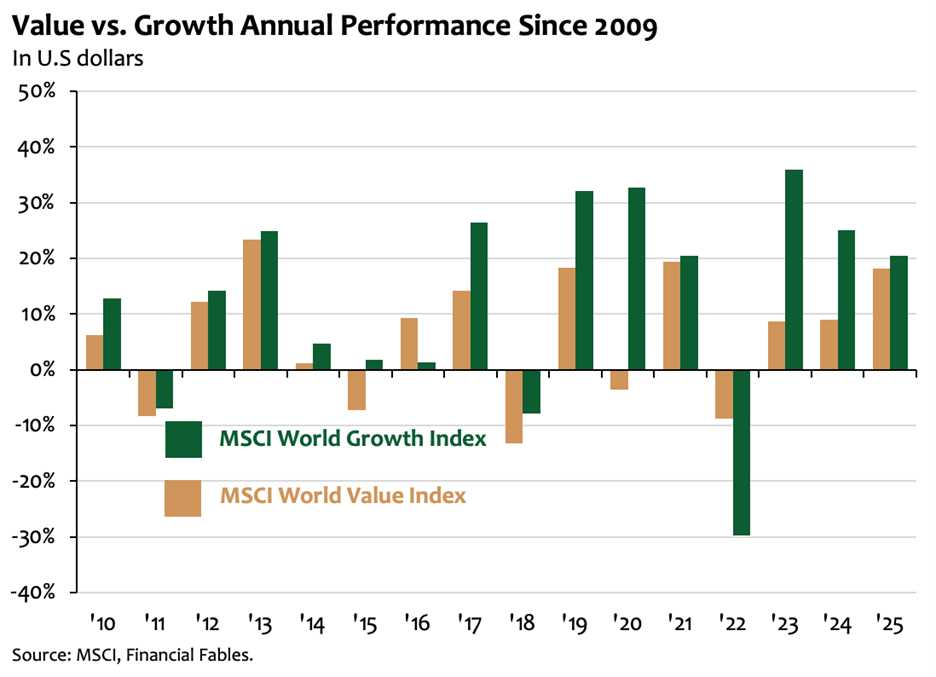

But over the past decade and a half, this match has been anything but balanced. As the chart below illustrates, since 2010 value has trailed growth in 14 of the last 16 years, lagging by roughly 7% per year on average. What should have been a close contest has started to look more like a one-sided beating.

So, while value investing might look like it’s slumped against the ropes, maybe it’s simply pausing before a surprise comeback. Dan has bravely taken on the task of defending a style of investing that appears close to a knockout. Dan, over to you…

Can Value Stage a Comeback?

I felt confident going up against Alex as my record stands as 1 and 0 versus our favourite macroeconomist. Last summer I championed gold and questioned the future of the dollar in one of my rare forecasting successes. However, in doing so I may have gotten a little cocky. Volunteering to defend value investors is certainly the more challenging side of the argument. Growth investors have of course grabbed the headlines. During the ZIRP and NIRP (zero and negative interest rate policy) experimental epoch, growth stocks behaved wonderfully, as they indeed should have. However, the seemingly knockout blow comes in the reality that an interest rate rising cycle did little to stir any sort of comeback.

However, I argue things haven’t been as bad as suggested, in fact they’re pretty good. The first post-covid US interest rate rise came on Feb 28, 2022. To the end of 2025, MSCI World ‘Growth’ has outperformed by 24.5% (in GBP terms). Not a great start, I admit. However, I pose that in taking this as the death of value as a discipline may open one up to the folly of selection effect. Between MSCI World Mid-cap Growth and Value the differential is a stomachable 6.5% and between the small cap iterations, value actually triumphs by 5.7%.

Things improve further when we shake off our developed markets bias. EM Growth has actually underperformed Value by 8% in this time. Mid cap EM Growth has underperformed its Value counterpart by 8.5% and the same is true for small cap - by a whopping 12.5%. I’ll spare you a further barrage of figures by asking you to trust me that it is the same result for both Japan and Europe. In fact, surprisingly, pretty much everywhere except the US has offered fertile ground for value investors. Although these datapoints are susceptible to the many novelties of index methodology, I do begin to wonder if the growth argument is Americentric? Perhaps just Mag-7centric? Is it therefore just a matter of time until we see good old value start to work in the US like the rest of the world? This feels more likely now than ever as we, arguably, approach the end of Pax Americana. Previously a sceptic, I’m starting to wonder if the time and patience needed to unearth value may indeed prove a virtue.

Growth Keeps on Punching

Dan puts forward a compelling case for why value might drag itself off the canvas, but I think growth still has two heavy punches that keep value on its knees: the rise of passive investing, and the fact that growth isn’t even as expensive as it first appears.

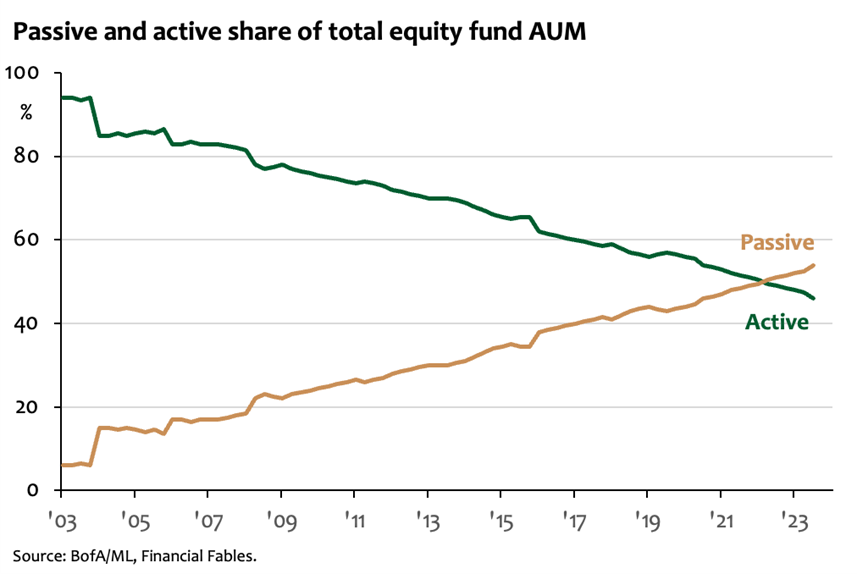

If value investing demands time and patience, today’s market seems to have little of either. Investors aren’t combing through balance sheets looking for overlooked bargains anymore; they’re funnelling money into passive, benchmark-tracking strategies. In that index-driven world, size feeds on size. The biggest companies in the major benchmarks - especially the S&P 500 - receive the largest inflows simply because of their weight. That steady stream of capital naturally favours the largest and fastest-growing firms.

This creates a structural headwind for value stocks. Many traditional “deep value” names barely feature in the big indices, so passive flows simply bypass them. Markets don’t stop to reassess whether these companies are mispriced; they’re too small to move the benchmark and therefore too small to matter for passive allocators. Growth stocks, meanwhile, benefit from a self-reinforcing loop: higher weights attract more inflows, which push valuations higher, which then justify even larger weights. As you can see in the chart below, passive flows have just crossed 50% of total equity flows, suggesting this dynamic is only getting stronger. This is a market structure that simply didn’t exist in anything like its current form for most of the 20th century - which makes historical comparisons much less comforting for value investors today.

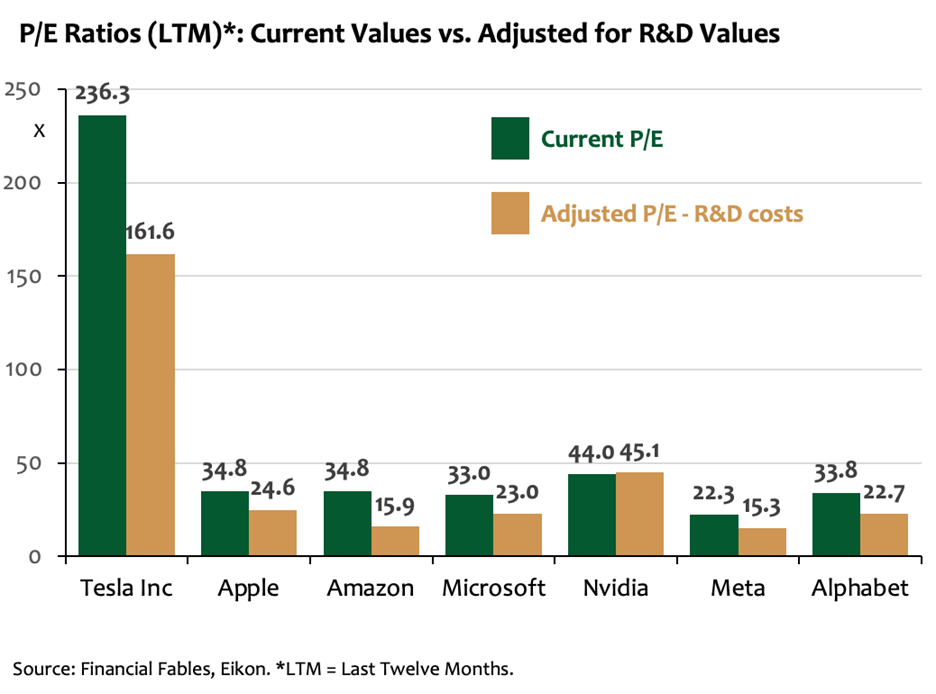

The second punch is that growth might not actually be as expensive as people claim. Traditional valuation screens - P/E ratios, price-to-book, cash-flow metrics - treat all R&D spending as if it were a routine, everyday cost, lumped in with salaries or raw materials. But R&D isn’t that kind of expense. It’s an investment in future products, intellectual property and technological capability; the digital equivalent of building a factory. If a company spends billions designing new chips or training advanced AI models, wiping all of that from current profits understates the real economic value being created. In effect, we’re treating investment as consumption.

Once you adjust for this distortion, the valuation picture looks very different. The chart below focuses on the Magnificent Seven - companies that dominate most growth-orientated portfolios. On an unadjusted P/E basis, they look expensive. But when we treat R&D as long-term investment and add it back to earnings, their valuations fall to far more reasonable levels. In other words, growth stocks may not be winning because they’re in a bubble - but because we’ve been systematically misreading what they actually earn.

Value Isn’t Dead Yet

I’ll happily concede Alex’s punches are well-aimed, especially the relentless rise of passives, but I don’t think they quite land the haymaker he’s hoping for.

If you extend the data beyond the last decade and a half, value doesn’t look like a chronic loser; rather a style going through an unusually long rough patch. ‘Value’ stocks have beaten pricier ‘growth’ stocks handsomely over the last 100 years. To cement my point, I drafted in a ringer in the form of Schroder’s value team who have calculated that $10,000 invested into US growth stocks in June 1926 would have generated $136m by end of 2024. The same money invested into US value: $1.4 billion! Colour this historic precedent with the current context of extreme valuation spread between value and growth, even allowing for Alex’s creative accounting, I see a fighter who’s lost a few brutal rounds and is now trading at long odds rather than a washed-up journeyman.

Alex is right that passive flows are poised to supercharge the divide and this time may indeed prove different. But we must remember index funds don’t have a particular penchant for growth; they just love winners. They buy whatever has gone up the most, at whatever price the market serves. That can inflate the same narrow group of mega-cap names and leave the rest of the market comparatively ignored. For a value investor that neglect is a feature rather than a bug. It can mean perfectly sound businesses trading at increasingly attractive discounts while benchmark buyers chase the same handful of stories. And if the names sitting in the value bucket lead for a few years, those same passive flows will dutifully rebalance into it. So rather than passive being a one-way structural headwind, in the long term it increases the opportunity for active investors willing to own what the index crowd is ignoring. The last piece to consider is that value investing, is a process that when done properly, has performed much better than the indices suggest. A certain developed global value fund has doubled the MSCI world since the first rate cut I mentioned in Feb 22. In my view, value is always executed better by active managers. When you add that frame, I believe it sounds increasingly like a value opportunity than a value obituary.

The Final Bell

So where does that leave our two fighters?

Dan and I agree on more than it might first appear. Both of us accept that the last decade and a half has been brutal for traditional value, that a small group of US mega-caps has done most of the heavy lifting in global markets, and that passive investing has changed how markets behave by amplifying whatever is already winning and leaving much of the market ignored.

Where we differ is on what that implies. Dan sees today’s narrow leadership and extreme valuation gaps as the kind of setup that has rewarded value investors in the past. I’m more sceptical: the mix of index-driven capital, winner-takes-most business models and the rising importance of intangible investment looks less like a cycle and more like a structural shift. If markets increasingly reward scale, networks and intellectual property, then “cheap” may stay cheap for a long time - and growth may keep winning for longer than value investors expect.

But the final bell hasn’t rung yet.

If you would like to speak with us about this update, or to discuss our discretionary investment management services in general, please do not hesitate to get in touch.

DOWNLOADS

Value vs Growth Stocks: A One-Sided Boxing Match?

Value vs Growth Stocks: A One-Sided Boxing Match?