Every Breakthrough Begins with Silicon

Follow the Chips (Follow the Money)

Too often, the term Artificial Intelligence (AI) is thrown around to describe the next boom in technological innovation, which it certainly is, but the word next is difficult to dissociate with something transitory. For every so-called “next big thing,” there’s usually a deeper, more enduring enabler behind it. In this case, that enabler is chips. The story of technological progress has never really been about the applications themselves, but about the compute power that makes them possible. AI may be the headline, but chips are the infrastructure.

From the first missile guidance systems and NASA’s Apollo computer to pocket calculators and the device you’re reading this on now; semiconductors (chips) have been the constant engine behind every major leap in technological progress. Therefore, my view is simple: follow the chips, follow the money, and you’ll find the roadmap to the next boom cycle. And for our statisticians out there, chips are the dependent variable for every x variable… the constant that determines how innovation scales.

The Chip

A semiconductor chip is, at its core, a thin wafer of silicon etched with billions of transistors, microscopic switches that control the flow of electrical current and perform logic operations at extraordinary speed. The invention of the integrated circuit in the late 1950s, by Jack Kilby at Texas Instruments and Robert Noyce at Fairchild Semiconductor, allowed multiple transistors to be combined onto a single substrate (base layer), turning what were once discrete components into compact, efficient systems-on-a-chip. Year’s later, Gordon Moore, Intel’s co-founder, predicted that the number of transistors on a chip would double roughly every two years while costs declined, an empirical concept known as Moore’s Law. This continuous miniaturisation makes chips exponentially more powerful, efficient, and underpins decades of progress, from room-sized computers to smartphones and, today, AI data centres.

Sputnik Moment

Semiconductors are the foundation of modern economic and military power. Every wave of technological progress since the 1950s. From the first computers to smartphones, cloud infrastructure and now artificial intelligence, has been driven by advances in chip design and manufacturing.

From the start, chips were never just about technology, they were instruments of power. The Cold War turned semiconductors into a strategic asset, as the Sputnik launch in 1957 pushed the United States to out-innovate rather than out-arm the Soviet Union, making the US the undisputed leader in transistor and integrated-circuit technology.

Today, that legacy continues through US control of the semiconductor ecosystem, where export restrictions, intellectual property protections, and supply-chain interdependence make it virtually impossible to manufacture an advanced chip without American components or software. China now finds itself in a modern-day Sputnik moment, racing to close the technological gap much like the Soviet Union once did. This deliberate protectionism reflects how governments perceive semiconductors, not merely as inputs to modern industry, but as strategic commodities that can drive economic strength and geopolitical influence, as history has repeatedly proven.

Evolution of The Innovation Cycle

Companies such as Fairchild Semiconductor and later Intel commercialised the transistor and laid the foundation for the modern compute era. The 1990s and early 2000s brought the rise of US fabless (i.e. those that outsource chip fabrication) chip designers like NVIDIA, Qualcomm and Broadcom, design-focused business models reshaped the economics of the industry. The following decade marked the rise of the foundry model, pioneered by TSMC, which separated chip design from manufacturing and turned advanced fabrication into a scalable, high-barrier business with a technological moat that few could replicate. Each phase produced a new set of winners, and investors who recognised the structural importance of chips captured extraordinary compounding returns. I.e., “Those who followed the chips, followed the...”

Artificial intelligence now represents the next structural driver; AI is not possible without breakthroughs in compute. Training ever larger models, processing vast data sets and running real-time inference (where a trained AI model applies what it’s learned to generate outputs) all depend on more powerful and efficient silicon. Chips are not a secondary play on AI growth; they are its engine room. The demand for GPUs, high bandwidth memory and leading-edge fabrication is therefore not a short-term trend but a multi-year capital cycle that is already reshaping global supply chains.

For investors, this translates into a clear opportunity. The economics of the sector favour the companies that control bottlenecks: NVIDIA in AI accelerators, TSMC in advanced manufacturing, ASML in lithography. Their pricing power and technological lead make them essential suppliers to every part of the digital economy. History supports this view. The PC boom, the smartphone era and the rise of the cloud all began with surging chip demand and delivered sustained equity outperformance for semiconductor leaders.

Data Centre Expansions

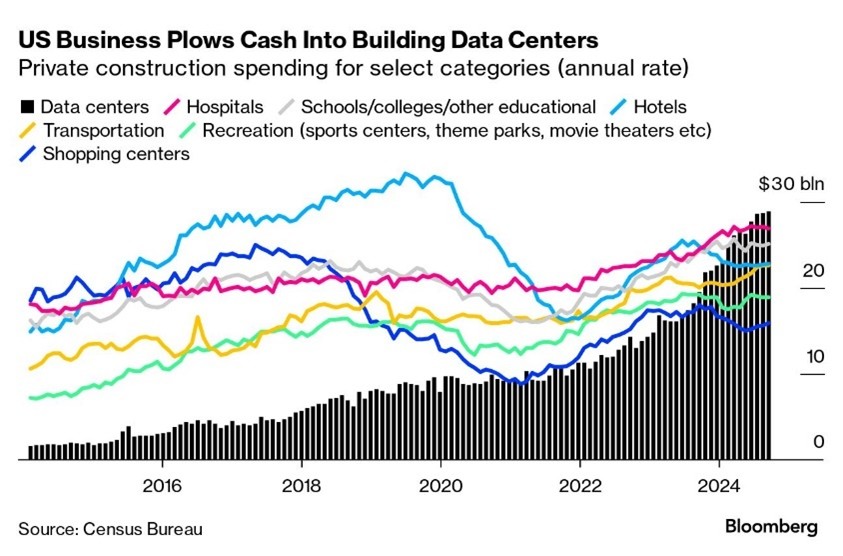

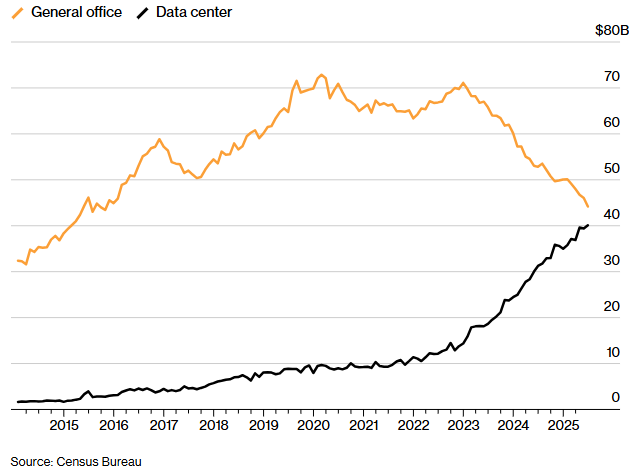

Data centres are specialised facilities that house the servers and networking infrastructure powering cloud platforms like Amazon Web Services (AWS) and are fast becoming factories of the digital age. As demand for computing power accelerates, capital is shifting away from traditional commercial real estate toward infrastructure built to house high-capacity servers and AI hardware (e.g., GPUs/CPUs). Data now shows that general office construction spend rolling over whilst investment in data centres is rising sharply and surpassing other forms of private development. In essence, data centres are the new growth engine of the information economy, driving demand for power, connectivity, and the chips that make AI possible.

AI Bubble vs Proven Profitability

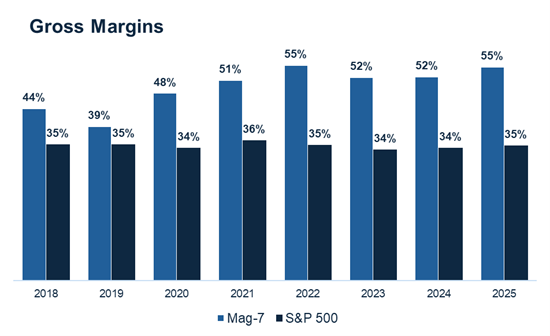

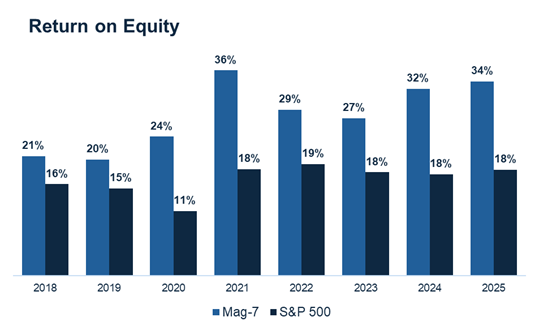

Lofty valuations are the pebble in AI’s shoe, raising eyebrows over whether the premiums paid for shares in hyperscalers, chip designers, and related beneficiaries are truly justified. As such, comparisons to the 1990s tech bubble are inevitable. However, unlike that era, today’s leaders are backed by solid fundamentals, in the form of high gross margins, strong free cash flow generation, and low leverage underpinned by recurring demand for compute power. This AI build-out is being driven by structural investment, not speculative capital chasing in unproven, unprofitable concepts.

Valuations may appear stretched on traditional metrics, but the scale of earnings growth and cash generation from AI adoption could provide some justification for current multiples. The “Magnificent Seven” (Mag-7) gross margins and return to equity (net income divided by common equity) relative to the broader market (S&P500) are great examples of fundamentals that command a higher premium than the market.

The purpose of this note is not to defend valuations or concentration levels, but to highlight the utility of chips in transforming industries and what history has repeatedly demonstrated about their economic importance. However, current levels of market-cap concentration among hyperscalers and AI enablers are being drawn to scrutiny. My view is that market-cap concentration is not simply a symptom of speculative excess but a reflection of earnings reality. For example, the Mag-7 account for roughly a quarter of the index’s market capitalisation yet contribute close to 40–45% of total earnings and an even larger share of aggregate free cash flow. In that sense, their index weight is broadly consistent with their economic output. Put differently, if these firms maintained the same earnings contribution but were valued equally to less profitable peers, the argument would shift to them being undervalued. That said, my conviction in the long-term utility of semiconductors extends well beyond the Mag-7. They are simply the most visible beneficiaries of a far broader structural transformation.

There are also concerns around the speculated circularity of AI investment, with some arguing that much of today’s demand is self-reinforcing. In other words, technology companies investing in AI infrastructure primarily to power their own models rather than to meet broad end-user adoption. While there is some truth to this in the near term, it overlooks the historical pattern of platform shifts: early investment cycles are almost always internally funded before broader commercial applications emerge. A good example of this interdependence was Intel’s multi-billion-euro investment in ASML in 2012 to accelerate the development of EUV lithography, securing early access to the technology that would enable its next generation of chips and sustain Moore’s Law. As AI capabilities expand and integration deepens across industries, boosting productivity and profitability in sectors beyond IT, the current concentration of investment can be seen as a necessary precursor to a broader economic payoff.

Beyond the Cycle

In the words of Chris Miller in Chip War, “little did Noyce or Moore know that Moore’s Law would one day power the AI revolution.” Semiconductors (chips) remain the foundation of global innovation. They have powered every technological shift, enabling automation, connectivity, and now intelligence itself. Allocating to the chip complex is, in many ways, an allocation to the future of productivity and digital infrastructure. As the AI build-out accelerates, semiconductors will continue to anchor global capital expenditure, shaping the next decade of returns.

While markets are fixated on AI as the headline story, my focus lies beyond and on its enabler. The long-term opportunity sits not in chasing the noise, but in recognising the enduring utility of chips. History has rewarded investors who looked past near-term exuberance and stayed invested through each technological breakthrough. “You can’t connect the dots looking forward; you can only connect them looking backward.” Chips provide that backward view, the constant that links every era of innovation, from missiles and mainframes to mobile phones and now artificial intelligence.

Those who followed the chips have consistently followed the money. And if history is any guide, those who continue to do so will follow the next great innovation cycle. My belief is simple; we’re only at the beginning of that next phase.

DOWNLOADS

Every Breakthrough Begins with Silicon

Every Breakthrough Begins with Silicon