23 January 2026 | James Penny

A Healthier Kind of Volatility

It looks like markets have been going through somewhat of a sea change in January in terms of both investment leadership but also geopolitics. Agreed, we have seen plenty of geopolitical turmoil over the last year but the market has taken much of it in its stride to continue to advance higher. What many might have missed is a slow deterioration in bullishness which has shown up in investor surveys. Looking closer, managers are still bullish on equities and increasing their allocation to stocks but increasingly less enthusiastic about doing so. Interestingly investors, despite this deterioration, remain overweight and, on...

Read the Full Note

20 January 2026 | Dan Babington

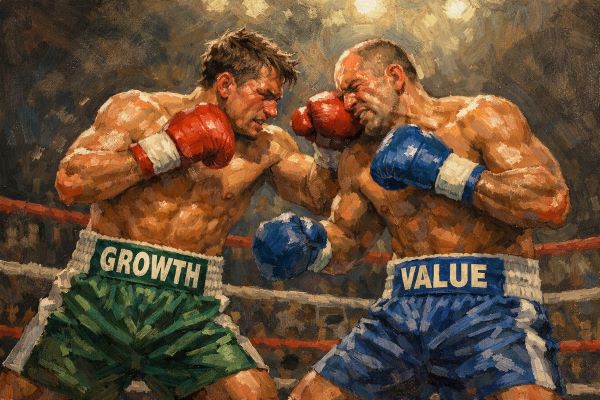

Value vs Growth Stocks: A One-Sided Boxing Match?

Have you ever wondered what one of TAM’s Investment Committee meetings looks like? Often, reaching a consensus takes much back and forth and sometimes it can feel like a bit of a boxing match. So, true to form we wanted to bring you our latest match up. In this note, framed as a classic head-to-head bout, Dan Babington, TAM’s Portfolio Manager and TAM’s Independent Macroeconomist, Alex Dryden look to determine whether growth or value investing will reign supreme in the years to come. This note was originally published on Alex’s macro blog Financial Fables. For weekly market insight you can...

Read the Full Note