December 2019

Ethical investing: The gift that keeps on giving

As we approach the festive season, and the end of what has been an action-packed year for investors, TAM’s Ethical portfolios have risen above the ranks to deliver some of the strongest returns over their long-term tenure on both an absolute basis and even relative to our ‘mainstream’ portfolios.

Read the Full Note

December 2019

A bad year for liquidity (if you are one of the unlucky)

Whilst the markets continue to show clients positive gains, for some investors a very good year for investment returns could have been a very bad year for liquidity. Retaining liquidity is a core part of investment management...

Read the Full Note

October 2019

Three hours too soon than a minute too late?

It’s been somewhat of a melancholy end to the third quarter for active managers. Two pieces of news have surfaced which serve to take the shine off the benefits of active management. Firstly, the news that the UK’s largest public sector pension scheme has been put under political pressure to dump its sleeve of active managers for passive investments, following the Woodford debacle which the fund had a position in.

Read the Full Note

September 2019

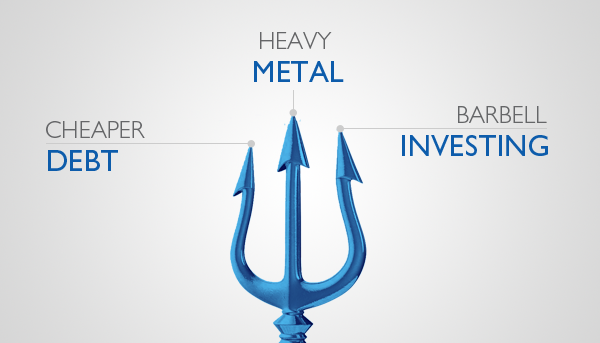

TAM's three-pronged approach

TAM Asset Management’s 2019 investment performance has, to date, outperformed its benchmark while maintaining a lower risk profile. This has been achieved with an overall cost reduction in headline fees back to clients...

Read the Full Note

July 2019

A glittering 6 months for gold

It is fair to say that over the last year, financial markets have taken investors on a rollercoaster ride, with markets rising, then tumbling, before recovering to reach all-time highs once again. But through all this, one of the only asset classes that has steadily risen to cut through the volatility is gold. We are pleased to say we joined this trade early, investing through gold-related equities as well as directly via an Exchange-Traded Commodity (ETC) product, and while a lot of asset classes have made a lot of money this year...

Read the Full Note

June 2019

Are you suffering from FOMO?

For most readers, “FOMO” or “fear of missing out”, might be a phrase you’ve heard bandied about the homestead by your millennial teenagers as they head off to university and is formally defined as, “a feeling of anxiety that an exciting or interesting event may currently be happening elsewhere”. Whilst there is no formal recognition that FOMO exists in the professional world, if you asked any investor they would certainly agree that stock market participants share the same fear of missing out as that of their children. If we were to link FOMO to a stock market term, then it...

Read the Full Note

June 2019

Balanced by name, balanced by nature?

As you are fully aware, IFAs are driven as part of the onboarding process, for clients to discern a risk profile that is appropriate for their circumstances. It’s a well-trodden path and we all know where we stand because Balanced means Balanced. But does it?

Read the Full Note

June 2019

Never put all your eggs in one basket

June 2019 I am sure you were as surprised and disappointed as I to read on Monday about the suspension of the LF Woodford Equity Income fund. The Fund managed by Neil Woodford (of Invesco Perpetual Income Fund fame) had, due to several reasons including concerns over recent performance, witnessed heightened investor redemptions of late.

Read the Full Note

March 2019

Taking a moment to pause

What do both May and October have in common for stock markets? They are both months when investors tend to adopt a decidedly negative view on stock markets. “Sell in May and go away, come back on St. Leger’s day” is an adage which refers to the custom of leaving London in the hot months between May and September for the cooler climes of the country.

Read the Full Note

January 2019

Active management is dead, long live active management!

Think back to the turn of the millennium, what were you doing? More than likely cracking open the bubbles to see in the dawn of a new era, perhaps some of us were fretting over the infamous Y2K computer meltdown heralded at the stroke of midnight!

Read the Full Note

Down, but not out!

2018 will hardly be remembered as a vintage year for global markets, in fact, it will likely be lamented with a grimace as the year that broke the back of the 10-year bull run and a year when investors were reminded, uncomfortably, that markets go down, as well as up.

Read the Full Note